what is suta tax california

For tax years 2022 2021 2020 and before. Due to the limited budget the American cast members and crew including George Lucas all decided to fly coach class to England rather than first classWhen Carrie Fishers mother Debbie Reynolds heard about this she called Lucas complaining about how insulting it was for her daughter to be flying coachFisher was in the room with Lucas when he took the call and after.

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Others may refer to it as unemployment insurance UI.

. In many states SUTA is an employer-only tax. For federal income tax and FICA you send this to the IRS. Once all the heavy calculations are complete your next step is to send the tax payments to the proper taxing authority.

Gauging and reporting on employee satisfaction. Employee satisfaction is a broad term used by the HR industry to describe how satisfied or content employees are with elements like their jobs their employee experience and the organizations they work for. We recommend you consult with your states Unemployment Revenue or Department of Labor for tax rates filing requirements and wage bases.

The State Unemployment Tax Act SUTA tax is much more complex. Click Manage Taxes under the applicable State Tax section. Quarterly Contribution Return and Report of Wages Continuation DE 9C Employer of Household Workers Annual Payroll Tax Return DE 3HW.

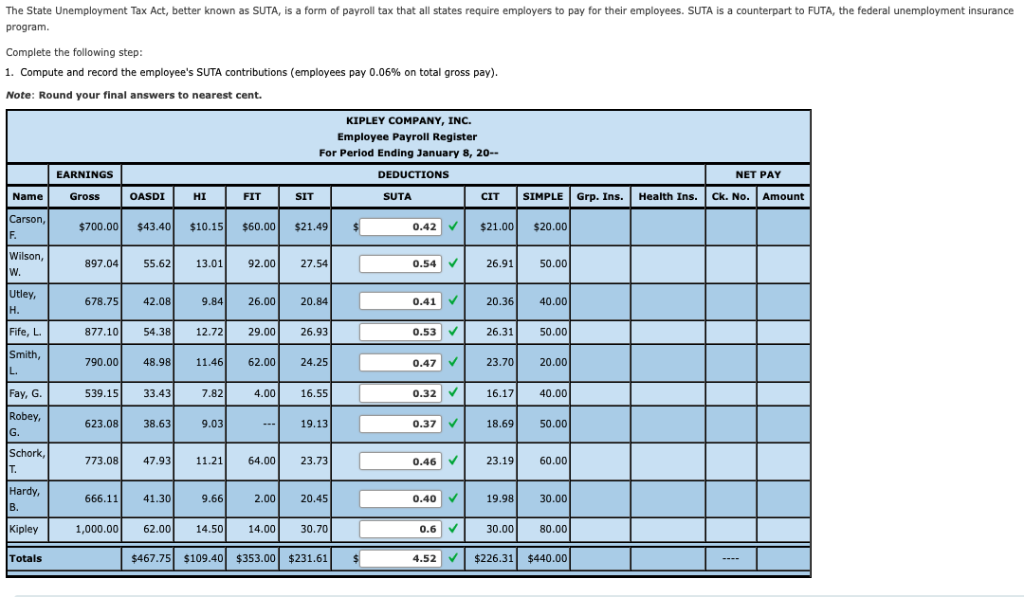

The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. For instance in California employees are taxed 66 for most supplemental pay but are taxed at 1023 if. Net pay is the actual dollars paid to the worker after all deductions.

Square Payroll also files payroll taxes to state agencies including state income taxes and state unemployment taxes SUTA where applicable. Performance management and goal tracking. Alaska Alabama Arizona Arkansas California Colorado.

Check out this list of state income tax rates that The Balance posted in January 2022. California DE 9C on Paper Quarterly Contribution Return and Report of Wages -Continuation. We answer your questions and help you get the job done.

Sales Tax varies by state between 0 to less than 10. Top 10 reason to choose our Tax Forms and Supplies. Neglecting to pay SUTA or SUI taxes can result in.

Click Add a new rate. FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings. Other state and local payroll tax rates differ by location.

States use funds from SUTA tax to pay unemployment benefits to. What is Employee Satisfaction. Employer of Household Workers Quarterly Report of Wages and.

Click on your state below to view which tax forms we handle in that state. Generally 25 Employers only. Going back to the California.

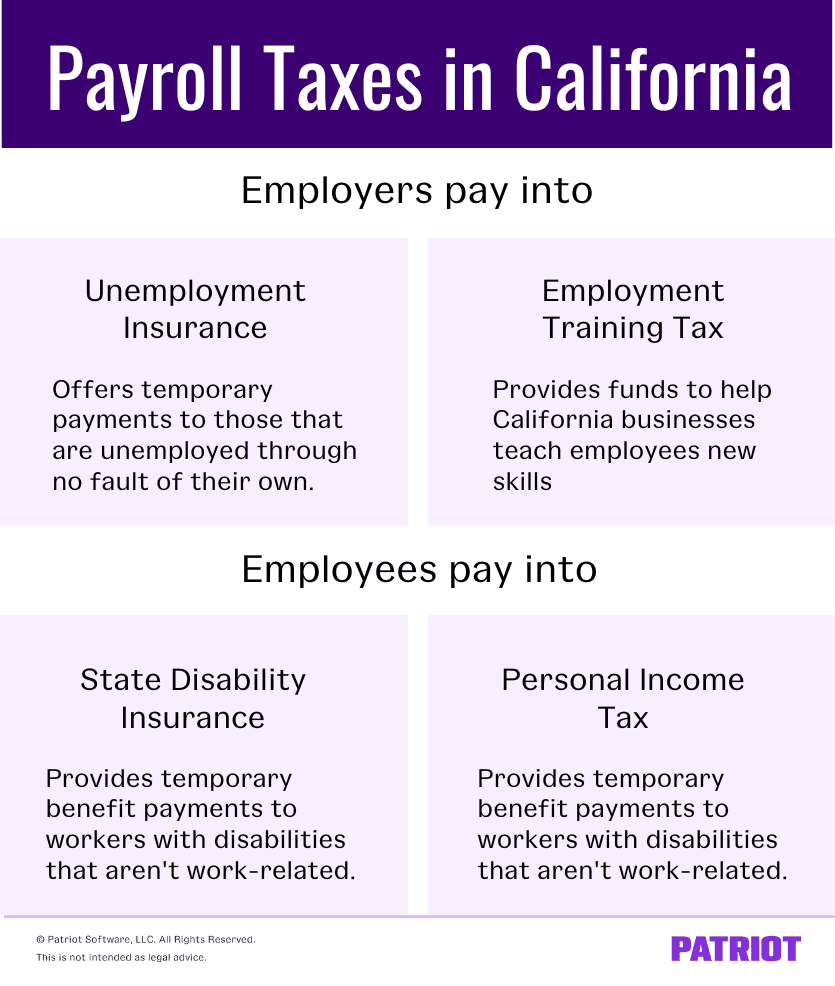

Can be reduced to 06 Employers only Medicare. California payroll tax is a series of 4 types of tax2 paid by the employer and 2 paid by the employeethat must be paid or withheld every pay period. Criminal charges to the employer.

State unemployment tax rates typically vary based on an employers previous claims history. California State Unemployment Insurance Tax CA SUI paid by the employer. If your notice says you have a rate of 055555.

In addition to FUTA employers typically must pay taxes to fund the states unemployment program or SUTA. Enter the number shown on the notice as a percentage rate. The percentage of State Unemployment Tax or SUTA varies by state.

Please refer to page 15 for additional information on PIT withholding or refer to the PIT withholding schedules available on page 17. Works with our W2 1099 software major tax payroll 1099 preparation software products. Each state determines the wage base or minimum earnings required for SUTA to be deducted.

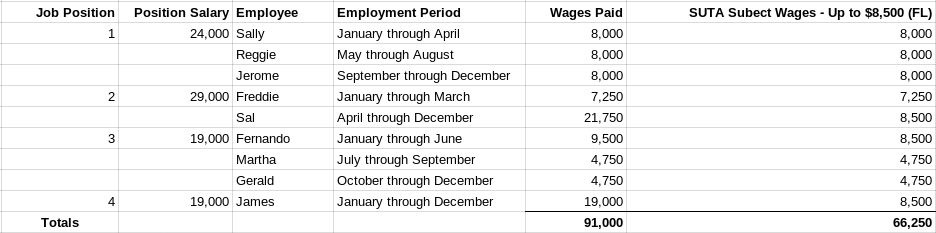

Tracking employee training for development and compliance. California Personal Income Tax PIT Withholding California PIT withholding is based on the amount of wages paid the number of withholding allowances claimed by the employee and the payroll period. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays.

State payroll tax forms. Each claim assessed to an employers account can result in a tax rate. State unemployment benefits.

The following tax returns wage reports and payroll tax deposit coupons are no longer available in paper. Employers pay a certain tax rate usually between 1 and 8 on the taxable earnings of employees. Calculates federal income tax withholding FIT state income tax SIT local income tax state unemployment tax SUTA state disability insurance SDI and federal unemployment tax FUTA.

A consumer tax collected for the government by the business and applied at the final point of sale retailer wholesalers etc. Click the Taxes compliance section and select Tax setup. State payroll forms support requires Payroll Mate Option.

The 4 payroll tax types are. Excluded SUTA Varies by State. These amounts are paid by the employer but also reported on the pay stub.

Depositing and filing payroll tax. Employers remit withholding tax on an employees behalf. How Unemployment Changes by State.

Unemployment programs are funded by the FUTA tax federal and the SUTA tax state. These taxes vary by state county and city. While the Federal Unemployment Tax is only paid by the employer some states require additional money to be withheld from an employees wages in addition to the amounts contributed by the employer for SUTA.

Since the tax is paid on every employees wages up to the state limit hiring more full-time workers and fewer part-time workers will bring down your SUTA tax bill. See how FICA tax works in 2022. Heres an example of calculating net pay.

Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage base. Scroll to State Tax Settings and click edit next to SUI Rate. But in some states like Alaska New Jersey and Pennsylvania youll need to withhold SUTA taxes from employees wages and remit them to the state.

As such a business with many previous employees who have filed unemployment claims will tend to have a higher rate than a business that has none. Guaranteed compatible with IRS and SSA regulations. Quarterly Contribution Return and Report of Wages DE 9.

While the Federal Unemployment Tax Act FUTA must be paid regardless of where youre located it shouldnt come as a surprise that each state also has its own State Unemployment Tax SUTA rules and regulations. In most states that ranges from the first 10000 to 15000 an employee earns in a calendar year.

How To Calculate Unemployment Tax Futa Dummies

What Is Sui State Unemployment Insurance Tax Ask Gusto

2022 Federal Payroll Tax Rates Abacus Payroll

Nanny Payroll Part 3 Unemployment Taxes

Understanding California Payroll Tax

How To Reduce Your Clients Suta Tax Rate In 2014

Glencoe Mcgraw Hill Payroll Taxes Deposits And Reports Ppt Download

What Is Futa Understanding The Federal Unemployment Tax Act Hourly Inc

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Futa Tax Overview How It Works How To Calculate

Ezpaycheck Payroll Software Futa And Suta

Reducing Unemployment Insurance Costs Ui Suta

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

What Is The Futa Tax 2022 Tax Rates And Info Onpay

What Is Sui State Unemployment Insurance Tax Ask Gusto

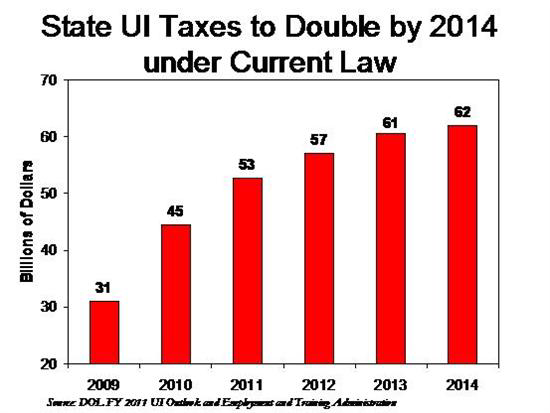

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

Ultimate Guide To Sui And State Unemployment Tax Attendancebot