vermont sales tax on cars

Learn more about the Vermont vehicle sales tax and what to expect. Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities.

New Kia Cars For Sale Suv S Berlin City Kia Of Vermont

Free Unlimited Searches Try Now.

. A 1 There is hereby imposed upon the purchase in Vermont of a motor vehicle by a resident a tax at the time of such purchase payable as hereinafter provided. Local option tax does not apply to the sale or rental of motor vehicles which are subject to the motor vehicle purchase and use tax. This page describes the taxability of.

In addition to taxes car purchases in Vermont may be subject to other fees like registration title and plate fees. Average Local State Sales Tax. The average total car sales tax in.

Vermont Sales and Use Tax is destination-based. There are a total of 155 local tax. Retail sales and use of the following shall be exempt from the tax on retail sales imposed under section 9771 of this title and the.

One of the following must happen for the purchased item to be subject. 9 Vermont Meals Rooms Tax Schedule. Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1.

While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Ad Lookup VT Sales Tax Rates By Zip. 6 Vermont Sales Tax Schedule.

Maximum Possible Sales Tax. Local Option Sales Tax. In Vermont the state tax rate of 6 applies to all car sales but the total tax rate includes county and local taxes and can be up to 7.

Local Option Alcoholic Beverage Tax. This document provides sales and use tax guidance for auto supply dealers auto repair shops. Local Option Meals and Rooms Tax.

Both dealers and repair shops must register with the Vermont Department of Taxes to collect. Average Sales Tax With Local6182. Use tax has the same rate of 6 rules and exemptions as sales tax.

Vermont collects a 6 state sales tax rate on the purchase of all vehicles. Sales tax can add a significant amount of money to your total car purchase.

Vermont Sales Tax Small Business Guide Truic

About Bills Of Sale In Vermont Key Forms Information

Car Tax By State Usa Manual Car Sales Tax Calculator

Used Vermont Auto Service For Sale With Photos Cargurus

Vermont Vehicle Sales Tax Fees Calculator Find The Best Car Price

Hecht Group Campers In Vermont Are Not Required To Pay Property Taxes

No Vt Sales Tax For Non Residents Buy A Subaru In Vermont At Brattleboro Subaru

How To Get A Vermont Dealer License 2022 Guide

Ford Cars For Sale Near Burlington Montpelier Vt

South Burlington Considers Sales Meals And Rooms Tax Increase

The States With The Lowest Car Tax The Motley Fool

How To Use The Vermont Title Loophole To Get A Vehicle Title Cartitles Com

Car Tax By State Usa Manual Car Sales Tax Calculator

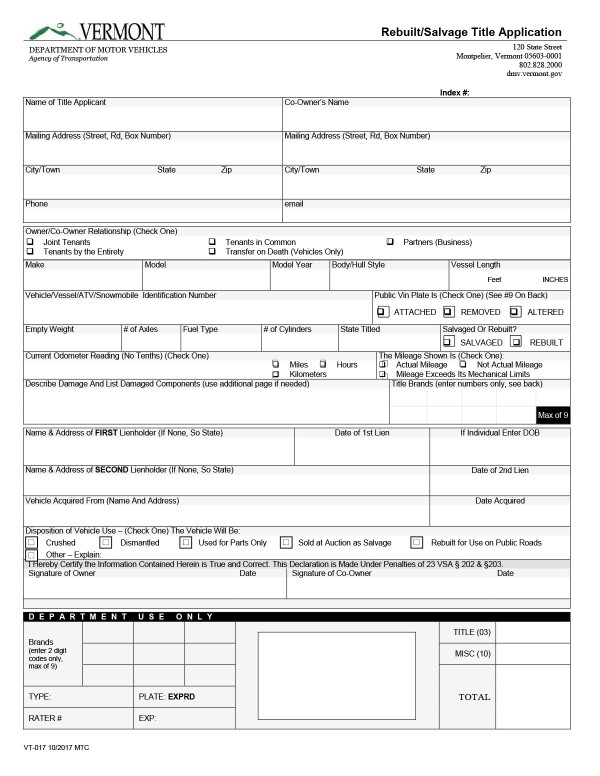

Tax Title Department Of Motor Vehicles

/cloudfront-us-east-1.images.arcpublishing.com/gray/EZRABZD6HNBIJNH3N4NDMRLXP4.JPG)

Vermont Looks To Replace Lost Gas Taxes From Those Driving Electric Vehicles

Dodge Charger Vermont State Police Patrol Car Profile Ebay

Used Cars Trucks Suvs For Sale In Montpelier Vt Preston S Kia Near Burlington Vt

Nj Car Sales Tax Everything You Need To Know

Pre Owned Used Cars For Sale In Connecticut Massachusetts And Vermont Gengras Motor Cars